An AI Bubble?

Photo by Braedon McLeod on Unsplash

If you're somewhat paying attention to the news lately, especially related to investment news, you've probably heard the phrase "AI bubble" and picked up on the general concern about it. Today, we're going to break down what the AI bubble is, why the AI bubble is, and what to do about the AI bubble.

With so much bubble talk, you may feel the urge to go outside and blow some bubbles, sing Ariana Grande's song The Girl in the Bubble (from Wicked 2), or embrace your inner 10-year-old and chew some Bubblicious gum (does that still exist?). Let's get to chewin!

What Is the AI Bubble?

Simply speaking, the term "AI bubble" is used to refer to the current and rapid increase in investment in the greater AI (artificial intelligence) sector that is ultimately affecting the economy. It's the idea that people are getting a little too excited about AI in a way that may not realistically last. Aka, that the returns and increases in company prices are rising faster than what real profits can keep up with.

Is that true? Hard to say. We can predict and suppose all we want, but only time will tell.

Why Is the AI Bubble?

Why is the AI bubble happening? Well because the world is making great leaps and bounds in artificial intelligence and technology. And a natural byproduct of that is AI being a focal point for investment. Capital is being invested in AI, expectations are changing as the technology continues to improve, and therefore prices are rising at seemingly astronomical rates. Plus, there's some concern around tech companies investing in tech companies to continue to push AI capabilities, which turns into quite the cycle, as the bubble feeds on itself. So naturally some people are concerned about all this and therefore fear the ramifications of such a bubble popping.

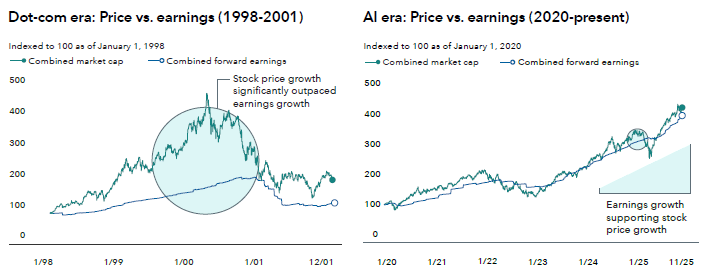

Some people have likened the AI bubble to the dot-com era of a couple decades ago. Is it? In short, no, this is very different, since relatively speaking, company earnings are keeping up with stock prices, which was not the case in the dot-com era.

Let's take a look at a couple of super interesting charts from Capital Group.

They show a comparison of stock prices vs. company earnings between the dot-com era and the AI era. In the dot-com era, prices got WAAYYY ahead of themselves, as you can see in the left chart below. Prices weren't supported by earnings, so that's why you see the big gap where the circle is.

Now let's look at the chart on the right side, which shows the comparison during the AI era. As you can see, there's not a huge gap anywhere because earnings have kept up with prices.

Does this mean there is nothing to worry about? No, there's a reason there is widespread concern about the AI bubble. But my encouragement is that we try to not get too ahead of ourselves either.

I think it can be helpful to look at other bubbles in history, or other concentrated technological advancements. Even when investors have gotten ahead of themselves during a time of great advancement, the lasting value that the various technologies have provided has been transformative.

Just look at air travel, railroads, electricity, and the internet, all of which provided times of excess and concentrated growth, and yet they all drastically and permanently impacted productivity and economic growth in a positive way. Will AI have the same long-term effect? Methinks probably yes. But time will tell.

What to Do Because of the AI Bubble?

Well first of all, let's not panic. Let's remember that nobody knows what's going to happen. And though that can be an argument for panic, it can also be a great reminder to remain calm. The various experts and non-experts throwing around terms like bubbles bursting and recessions and bear markets cannot be sure of anything. History has shown us that time and time again.

Are we about to go through a major bear market? Maybe.

Should that cause you to change your investment picture? Probably not.

In general, these are my thoughts when it comes to making changes to your investments:

You SHOULD NOT change your investment picture if…

you think we’re headed for a recession.

you think stocks are expensive.

you worry about the political or geopolitical landscape.

you think we’re about to go through an economic boom.

Why? Because we’re terrible at predicting what will actually happen next. Even the experts. Heck, especially the experts. Even if our fears or suspicions are correct, that doesn’t mean the stock market will behave the way we think it will.

And remember, if you try to time the market, you have to time the market right twice. First when you exit, and second when you enter again (or vice versa). I don't know about you, but that sounds like a lot of guessing.

On the other hand, you SHOULD change your investment picture if…

your balance of stocks and bonds is out of whack due to the stock market doing so well the past few years.

you go through a process of defining your target asset allocation (ideally with a financial advisor) and you find your current asset allocation is either too risky or too conservative.

your life circumstances have changed such that adjusting your asset allocation would be prudent.

So in the end, are we in an AI bubble? Maybe, maybe not. Are we in danger of a bubble bursting and causing market mayhem? It's possible. But is it for sure? Not in the slightest. So what should we do? Rebalance your portfolio when necessary, periodically, and not because of what you think might happen in the market.

One Final Thought

Are there things to be concerned about when it comes to the world and the markets? Absolutely. I have grave concerns about some of the happenings in the United States right now. And for some people, that includes the potential for an AI bubble.

But my advice is that we shouldn’t overreact when it comes to our investments. History has shown us that, yes, the bad times come, but they also go. And staying invested is the best way I know of to make sure we capture the ups of the market.

History has proven that time in the market beats timing the market, time and time again. Stay the course my friends.