Case Study #1

Patricia:

Financial Services Employee About to Retire

The Situation:

Patricia, an associate for a large financial services firm for 25 years, is getting ready to retire. She’s really hoping to do so during the next year or so.

Patricia has big dreams and exciting plans for life after work, but she’s wondering if she’s making the right choice to retire at this time. She doesn’t know a whole lot about personal finance, investing, planning for taxes, etc., and feels like she could use some help.

Does she have enough savings to be able to retire? How will she make her money last during retirement?

She’d also love to leave a decent amount of money to her children and to charity, so how does that factor in?

Plus, there’s the topic of taxes. Wonderful, lovely taxes. Is she going to be stuck with a huge tax bill for the rest of her life? Is there anything she can proactively do about it?

Our Approach:

The appropriate service for Patricia would be Comprehensive Financial Planning.

As with all Comprehensive Financial Planning clients, we would at least consider each area of the Circle of Financial Health, and then do a deep dive into the ones that pertain to that particular person’s situation. For Patricia, we would likely focus on Investments, Tax Planning, Retirement Planning, and Estate Planning.

Strategies:

First, we would take some time to clarify and understand what Patricia’s life may look like during retirement. A life of leisure? A second career? Volunteering? More time with family? The idea is to think through her goals and life priorities, and get a better idea of what the money is ultimately for.

Next, we would spend some time getting a handle on Patricia’s current financial picture. Both in high-level terms, as depicted by this visual:

And in nitty-gritty terms (get ready to squint):

Spending strategy:

In order to answer the question of how much Patricia can spend during retirement, we would do an analysis such as what’s below.

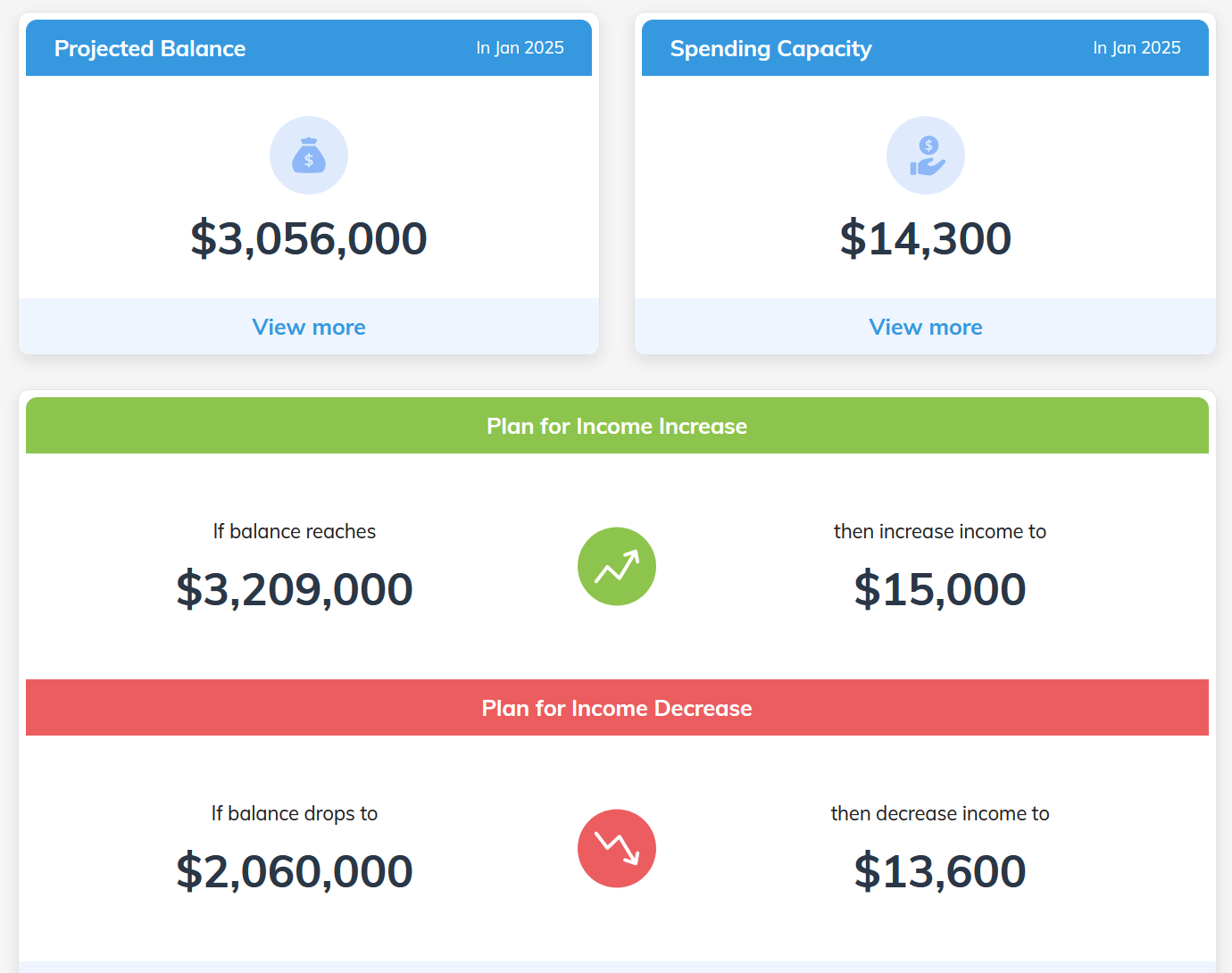

For example, if we were doing the analysis in July 2023, and she wanted to retire in January 2025, we would look at her assets, spending preferences, health expectations, and risk profile to determine her “spending capacity”. That is, an initial amount of money she can spend each month that balances (1) her being able to spend on what’s important to her, (2) putting her in a position to not run out of money long-term, and (3) supporting any inheritance goals she has for her family.

If that amount doesn’t seem like enough to Patricia, then we’d talk about potential adjustments, such as waiting longer to retire, working part-time after retirement, reducing spending, or adjusting her legacy goals.

For example, her initial spending plan may look like what’s below. Notice that it would include an income adjustment plan, where Patricia’s spending capacity may rise or fall depending on the level of her portfolio and other economic factors. The goal would be to allow her to spend as much as she’d like, without going too far and jeopardizing the health of her plan.

Other strategies we may consider for Patricia:

The timing of her retirement, with an eye toward maximizing her employer benefits & bonuses.

Options regarding what to do with her employer retirement plan.

An appropriate investment rebalancing strategy.

Reduction of taxes through the appropriate use of strategies such as Roth conversions and charitable contributions.

An optimal plan of when to file for Social Security benefits.

Considering whether purchasing a long-term care insurance policy makes sense.

Making sure she has a path forward regarding her health insurance needs.

Ensuring she has enough to fund what matters most.

The ultimate goal would be for Patricia to be able to enjoy the peace of mind that comes from a clear financial plan and overall Financial Health.

Note: The above case study is hypothetical and does not involve an actual Spencer Financial Planning client. No portion of the content should be construed by a client or prospective client as a guarantee that he/she will experience the same or a certain level of results or satisfaction if Spencer Financial Planning is engaged to provide investment advisory services.

Case study numbers were entered into Income Lab software to create the visuals above.